Contrasting Debt Loan Consolidation Choices: More Discussion Posted Here

Wiki Article

The Crucial Duty of Know-how in Carrying Out an Effective Financial Debt Monitoring Plan

Significance of Expert Advice

The relevance of professional advice in browsing the intricacies of financial obligation administration can not be overstated. Expert guidance plays a crucial function in developing and carrying out an efficient debt monitoring strategy. Competent financial advisors bring a riches of understanding and experience to the table, making it possible for companies and individuals to make educated choices regarding their monetary responsibilities.Professional advice assists in evaluating the existing economic scenario properly. By examining revenue, costs, and financial debt degrees, professionals can customize a financial obligation management plan that aligns with the client's economic capabilities and goals (More Discussion Posted Here). Additionally, economists can discuss with financial institutions in support of their clients, potentially protecting lower rates of interest, prolonged repayment terms, or perhaps debt settlements

In addition, professional advice infuses discipline and liability in the financial obligation administration procedure. Advisors give ongoing assistance and tracking, making sure that the strategy remains on track and modifications are made as needed. With professional advice, individuals and companies can navigate the intricacies of financial obligation monitoring with confidence and quality, ultimately paving the method towards financial stability and liberty.

Recognizing Financial Obligation Alleviation Options

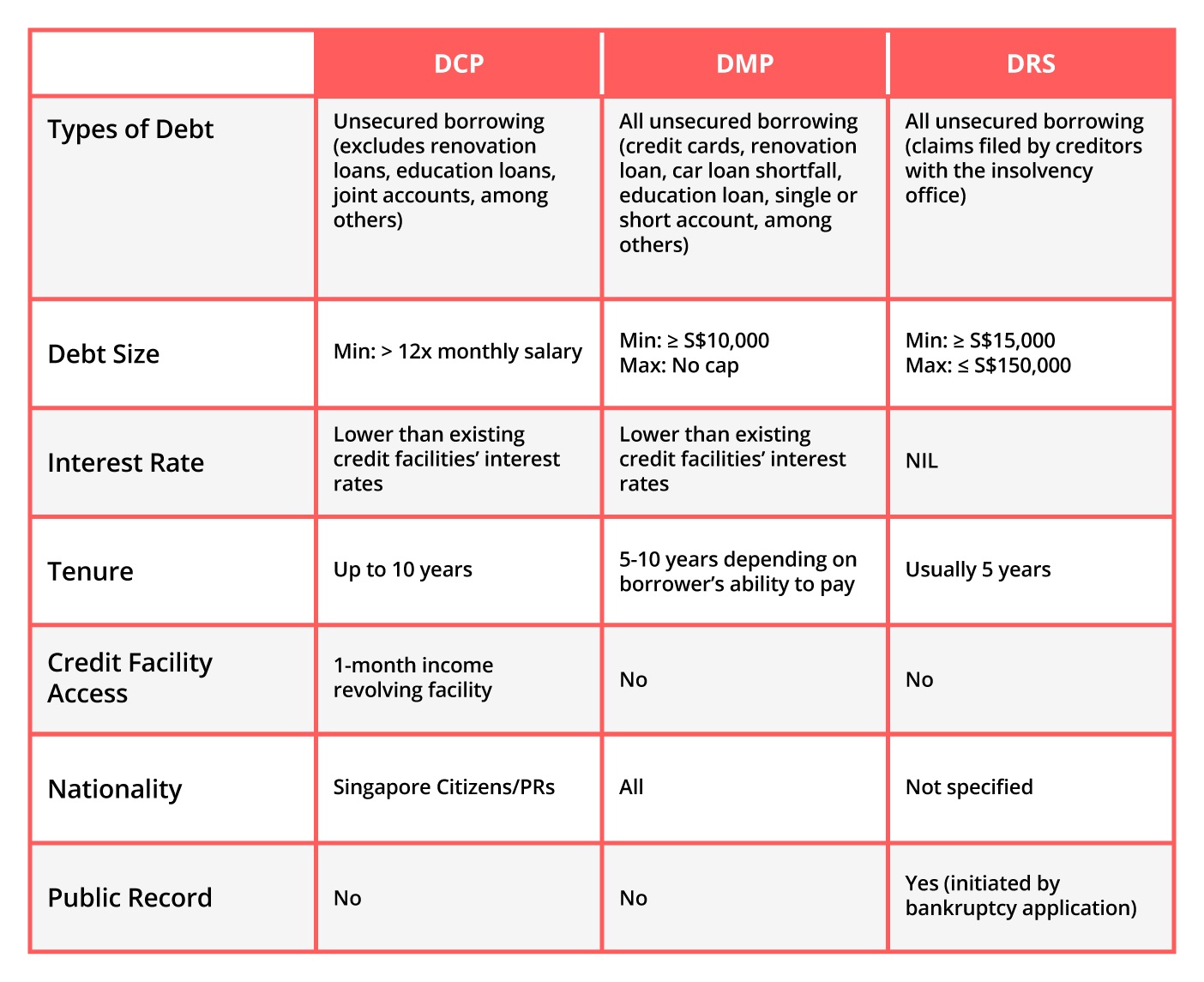

An in-depth exploration of viable debt alleviation choices is vital for individuals and companies looking for to ease their financial burdens effectively. When confronted with frustrating debt, comprehending the various financial debt relief alternatives available is essential in making notified choices. One typical technique is financial debt loan consolidation, which involves combining several financial debts into a single funding with potentially reduced rate of interest. Debt negotiation is one more option where negotiations with financial institutions cause a lowered general debt quantity. For those encountering severe monetary difficulty, bankruptcy might be thought about as a last resource to eliminate or reorganize financial obligations under court guidance. Each of these options has its implications on credit report, monetary security, and lasting effects, making it imperative to meticulously weigh the benefits and drawbacks before proceeding. Consulting from economic professionals or credit score therapists can provide important understandings right into which financial obligation alleviation option straightens best with one's distinct economic scenario and objectives. More Discussion Posted Here. Inevitably, a well-informed decision pertaining to financial obligation alleviation options can lead the method towards over here a more protected and steady monetary future.Negotiating With Creditors Efficiently

Exploring efficient arrangement methods with creditors is vital for people and organizations navigating their financial obligation relief alternatives. When negotiating with creditors, it is vital to come close to the conversation with a clear understanding of your financial scenario, including your income, expenses, and the amount of debt owed. Openness is essential throughout these discussions, as it helps construct count on and reliability with creditors.One reliable approach is to recommend an organized payment strategy that is workable and sensible based upon your present monetary capacities. This shows your commitment to meeting your obligations while likewise recognizing the difficulties you may be encountering. Additionally, supplying a round figure settlement or asking for a lower rate of interest can also be viable negotiation methods.

In addition, remaining tranquility, considerate, and professional throughout the settlement process can dramatically boost the likelihood of getting to a mutually advantageous contract. It is necessary to document all interaction with lenders, consisting of arrangements reached, to prevent any misconceptions in the future. By using these settlement businesses, people and methods can function towards resolving their debts properly and responsibly.

Customized Financial Debt Management Approaches

In creating efficient financial obligation management methods, customizing the technique to suit the unique monetary circumstances of people and companies is necessary. Customized financial obligation administration techniques entail a personalized assessment of the borrower's economic scenario, thinking about aspects such as revenue, expenditures, arrearages, and future economic goals. By customizing the debt administration plan, specialists can produce a customized roadmap that deals with the certain needs and difficulties of each customer.One key element of customized financial obligation management techniques is the advancement of possible and sensible settlement plans. These plans are structured based upon the person's or company's monetary capacities, making certain that they can meet their responsibilities without causing unnecessary monetary stress. Additionally, personalized approaches might involve bargaining read what he said with creditors to secure much more desirable terms, such as lower rate of interest or extended repayment durations, even more easing the concern on the borrower.

Monitoring and Adjusting the Strategy

Reliable financial debt administration professionals understand the relevance of continually keeping track of and readjusting the tailored payment plan to ensure its performance and placement with the customer's economic conditions. Tracking entails frequently tracking the progress of the financial obligation administration strategy, evaluating the customer's adherence to the agreed-upon repayment timetable, and determining any kind of discrepancies or barriers that might occur. By consistently checking the plan, experts can proactively resolve issues, offer needed support, and protect against prospective obstacles.

Routine communication between the financial debt management specialist and the client is essential throughout the surveillance and readjusting process. Open up discussion allows for clear conversations concerning any kind of modifications or difficulties, enabling both celebrations to interact efficiently towards the client's monetary objectives.

Verdict

In verdict, competence plays an important duty in implementing an effective financial obligation management strategy. Professional guidance assists people recognize debt relief options and discuss with creditors properly. Custom-made financial debt management techniques are necessary for producing a plan customized to each individual's demands. Normal surveillance and changes ensure the plan continues to be reliable in assisting individuals manage and ultimately eliminate their financial debt.By evaluating earnings, expenses, and debt degrees, specialists can customize a financial debt administration plan that aligns with the customer's financial abilities and goals. When encountered with frustrating debt, recognizing the numerous debt alleviation alternatives offered is crucial in making educated decisions. One common technique is debt consolidation, which includes integrating multiple debts into a solitary lending with possibly reduced rate of interest prices. Financial obligation settlement is one more alternative where arrangements with lenders result in a lowered overall debt amount. Customized financial obligation management strategies include a tailored assessment of the debtor's monetary circumstance, taking right into account aspects such as revenue, expenditures, superior financial debts, and future monetary objectives.

Report this wiki page